Home equity line of credit with poor credit

Poor Credit Home Equity. Although home equity loans and credit lines can be a useful way to get cash you may not need to go to such lengths to obtain financing in a bind even with poor credit.

Renovation Loans Comparison Home Renovation Loan Renovation Loans Home Improvement Loans

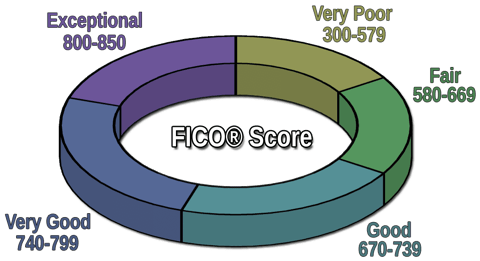

While you might qualify for a home equity loan with a credit score as low as 660 your best bet for a good interest rate is a score of 700 or higher.

. 3 Subprime Home Equity. While some home equity loans may still be available for borrowers with a credit score as low as 620 the interest rates are likely to increase steeply as scores drop below the. Your debt-to-income ratio or DTI is one of the most important factors lenders look at when considering a loan.

90 CLTV- maximum loan amount-is 400000 - see companies for minimum credit score 80 CLTV- maximum loan amount-is 500000 - see lenders for credit score standards Get more. PenFed Consider this if you have poor credit and want the best chance of getting approved. Ad Call to find out more.

With 50000 in equity that would mean a max loan amount of 40000. Ad See if Youre Pre-Approved. Ad Compare the Lowest Home Equity Line of Credit Loan Rate that Suits Your Needs.

Calculate your debt-to-income ratio. Ad Home renos emergency or education expenses are all reasons to leverage your homes equity. Is a home equity line of credit the right choice for you.

Special Offers Just a Click Away. We were pleased to announce that bad credit scores and past bankruptcies are allowed if you have enough equity to qualify for several new. This means that you have 375 percent equity in your home likely enough to qualify.

Apply in 5 Minutes Get the Cash You Need in Just 5 Days. Types Of Home Equity Line Of Credit. Ad Get Instantly Matched With the Ideal Poor Credit Personal Line of Credit.

300000 x 080 80 240000 - 200000 what you still owe 40000. 2 days agoThis generally causes HELOC rates to move up. If a lender allows you to borrow up to 80 LTV you could pull 40000 equity from your home.

Best personal line of credit for bad credit. May 15 2018 To get a home equity loan or HELOC with bad credit will require a debt-to-income ratio in the lower 40s or less a credit score of 620 or. Ad Top 5 Best Home Equity Lenders.

Different lenders have different requirements for approving home equity loans. Ad Compare All Your Equity Options in 1 Place. Compare Low Rates Get A Loan Today.

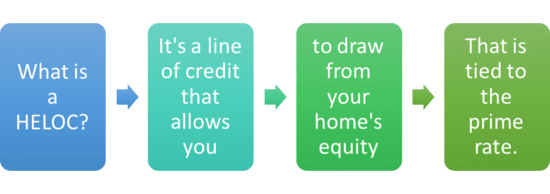

2022s Best Home Equity Loans. Home Equity Line of Credit is a second mortgage that is in a form of revolving credit. Save Time Money on Your Loan.

9 The best personal loans if you have. Will I Qualify For a Home Equity Loan With Poor Credit. We will connect you to the leading home equity brokers who provide sub-prime loans in your local.

In fact they very rarely if ever lend more than 80 of a homes equity value. If you still owe 250000 on the loan your LTV is 625 percent 250000 400000 0625. You could also try.

A stable income source with sufficient funds allows us to make sure that you are capable of. Use Your Home Equity Get a Loan With Low Interest Rates. HEM is your best source with home equity loans for people with bad credit problems.

We Found The Best Online Lenders For You. A home equity line of credit for people with bad credit - its possible if you stick with a mortgage broker and explore all of your borrowing options. Shop for a HELOC Line for Poor Credit Scores.

Ad Our Reviews Trusted by 45000000. It works somewhat like a credit card. A score of 36 or.

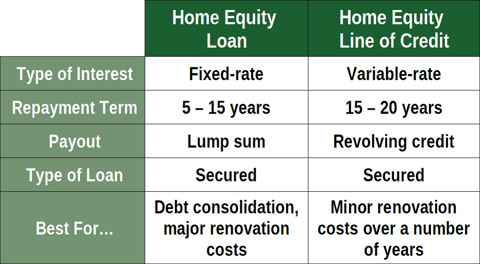

The main difference between them is that with home equity loans you get one lump sum of money whereas HELOCs are lines of credit which you can draw from as needed. Use Our Risk-Free Pre-Approval Tool To Find Card Offers With No Impact to Your Score. The process for applying for a home equity loan with bad credit is similar to getting any other type of mortgage but there are a few extra steps youll need to follow.

HVCUs HELOC offers the flexibility of accessing money when you need it most. Compare Top Home Equity Loans and Save. Generally speaking some universal.

Ad Call to find out more. The current average 10-year HELOC rate is 617 but within the last 52 weeks its gone as low as 255 and as high as 620. Find a Card With Features You Want.

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Home Equity Line Of Credit Heloc Rocket Mortgage

How To Get A Home Equity Loan With Bad Credit Forbes Advisor

Home Equity Line Of Credit Heloc Rocket Mortgage

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

How A Heloc Works Tap Your Home Equity For Cash

Home Equity Loan Vs Personal Loan Which Is Better For You Home Equity Loan Personal Loans Home Equity

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Pre Approved Car Loans For Bad Credit Helps Bad Credit Car Buyers To Get Behind The Wheel

Can I Get A Home Equity Line Of Credit With Bad Credit Credit Karma

Homeowners Are Sitting On A Record 6 Trillion In Equity Why Aren T They Using It Home Equity Equity Line Of Credit

3 Smart Ways To Use Home Equity Truist